Old Republic Guaranteed Asset Protection, also known as GAP, helps cover some of the financial gap between the actual cash value of a vehicle and the payoff amount of the loan or lease in the event of a total loss.

Please print the GAP Claim Reporting Form located on the Initiate GAP Claim page. The form consists of nine items we need to process a claim. Gather the required documents and forward by mail, fax or e-mail within 90 days from the date of the Primary Insurance company settlement. The e-mail address, fax number and street address are shown on the GAP Claim Reporting Form.

The Settlement Breakdown provides the calculation used by the Primary Insurance Company for the primary insurance company's settlement. Figures included on the breakdown are: Actual Cash Value (ACV) report of the vehicle as determined by the primary insurance company, sales tax, title fees, insurance deductible, and any deductions for prior damage or salvage, etc. The settlement figure should match the primary insurance settlement check. You can obtain this document from your primary insurance carrier.

This is a report that the insurance company uses to determine the actual cash value of your vehicle. Examples include: Kelly Blue Book, CCC Valuescope, NADA and Autosource. The ACV report can be obtained from your primary insurance carrier.

The Retail Installment Sales Contract or Security Agreement shows the amount you have financed, when the payments are to begin, term of the contract (loan) and amount of each payment. It will also list any items financed with the purchase of the vehicle, such as extended warranty, credit life, disability policies, tire and wheel coverage or maintenance protection plans. These items are cancelable and the unused portion of these premiums will go toward reducing the amount of your loan. The bill of sale/buyers order is your receipt for the vehicle purchase. It will detail the date of vehicle purchase, the vehicle's odometer reading at the time of purchase and the vehicle identification number (VIN). If you do not have a copy of this document, a copy can be provided to you by your lender or seller of the vehicle.

The loan payment history provides us with information necessary to calculate your GAP benefit. In addition to providing your account/customer/loan number, the loan payment history documents payments made, late charges incurred, fees and overpayments. The loan payment history may be obtained from your lender.

The police report documents the vehicle loss and provides us with the date of loss, the vehicle identification number, vehicle owner and/or driver, and the police officer's summary of the incident (narrative, diagrams, and citations).

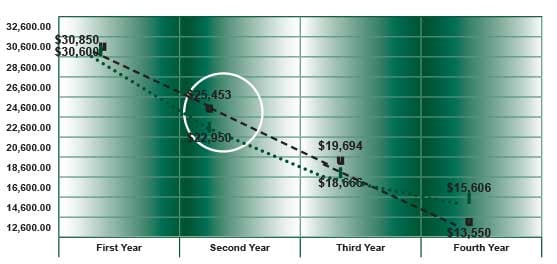

This graph illustrates your estimated limited liability during the term of your loan.

Loan/Lease Term: 60 months

Loan/Lease Amount: $32,600

Loss Occurs Second Year of Loan

Actual Cash Value: $22,950

Loan/Lease Payoff: $25,453

What You Will Still Owe: $2,503

Insurance Deductible: $1,000

Potential Out-of-Pocket: $3,503

GAP Payment to Dealer/Lender/Lessor: $3,503

Your Net Cost: $0

ORIAS considers your vehicle a “Total Loss” when your Primary insurance company determines that the cost of repairs exceeds the value of the vehicle. In the absence of Primary insurance, the covered vehicle must be available for the GAP Administrator’s inspection to verify that it is a total loss and determine its Actual Cash Value immediately prior to the Date of Loss.

For questions regarding coverage for a total loss, call one of our customer service representatives at 800.331.3780.